What is cash flow in Excel?

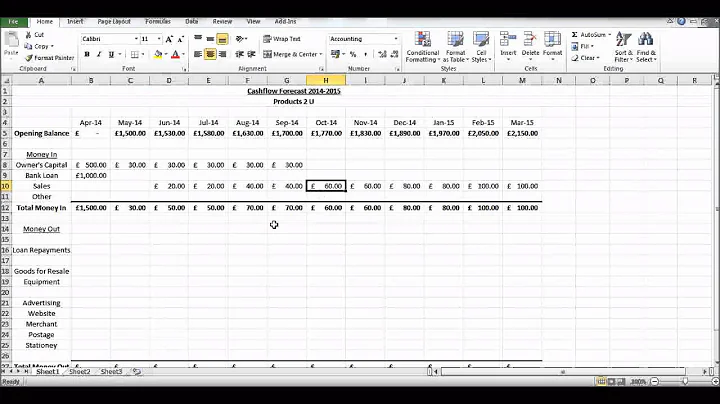

An actionable cash flow statement in Excel. We can see that a cash flow statement displays cash inflows and outflows from operations, investments, and financing activities. The final items clearly show the amount of cash and cash equivalents that a company had at the beginning of the period and the end of it.

Cash flow refers to money that goes in and out. Companies with a positive cash flow have more money coming in, while a negative cash flow indicates higher spending. Net cash flow equals the total cash inflows minus the total cash outflows. U.S. Securities and Exchange Commission.

How to Calculate Free Cash Flow. Add your net income and depreciation, then subtract your capital expenditure and change in working capital. Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure.

The primary purpose of the statement is to provide relevant information about the agency's cash receipts and cash payments during a period.

Cash flow statements are essential for your financials. They show us how well a business uses it's cash and how healthy its operations are. A good cash flow analysis will tell you if a company can pay its bills on time and if it has enough cash to sustain operations in the future.

Examples of operating cash flows include sales of goods and services, salary payments, rent payments, and income tax payments.

Cash Flow Statement formulas are pretty simple. All you need is to use the sum command to subtotal each category. First, select the Net Cash Flow - [Category] cell under the corresponding period and category subtotal. Then, type =sum( and choose all the cells for each section.

No, there are stark differences between the two metrics. Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

What's the purpose of a monthly cash flow report? The primary aim of the monthly cash flow report is to present an overview of the financial activity experienced throughout the month. Organizations rely on monthly cash flow statements to closely monitor cash inflows and outflows.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Why is cash flow better than balance sheet?

A balance sheet is a summary of the financial balances of a company, while a cash flow statement shows how the changes in the balance sheet accounts–and income on the income statement–affect a company's cash position.

There is no need to compare whether a cash flow statement or balance sheet is more important. They both reveal unique insights and information about a business's finances and can be used to create informed future decisions and forecasts.

Positive cash flow indicates that a company brings in more money than it is spending and has enough cash to continue operating. Negative cash flow is the opposite of this — when there is more cash outflow than inflow into the company.

If the inflow is higher than the outflow, the company is having positive cash flow. A negative cash flow situation arises when cash outflow exceeds the inflow. Business investments with a good long term cash flow prospects often generate poor cash flow in the short term (or the early years).

Cash flow statements, on the other hand, provide a more straightforward report of the cash available. In other words, a company can appear profitable “on paper” but not have enough actual cash to replenish its inventory or pay its immediate operating expenses such as lease and utilities.

Cash flow is defined as the incomings and outgoings of cash pertaining to the operating activities of a business. For example, a business' incomings are the receivables (payments) from customers and clients, while its outgoings are its expenses, such as payroll and leasing office space.

The main difference between a profit and loss statement and a cash flow statement is that a profit and loss statement measures the profitability of the business model while a cash flow statement shows where your money is coming from, where it's going, and how much cash you actually have on hand at a given point in time ...

Cash flow positive vs profitable: Cash flow is the cash a company receives and pays, but profit is the total revenue after disbursing all business expenses. Although being cash flow positive in most situations implies that the company is incurring profits, the two aren't the same.

- Avoid being short of cash. Keep a cash reserve, ideally three months' worth of expenses on hand, for unforeseen expenses and emergencies. ...

- Improve inventory management. ...

- Collect receivables promptly. ...

- Optimize accounts payable. ...

- Lease equipment instead of buying.

Generally, you must include in gross income everything you receive in payment for personal services. In addition to wages, salaries, commissions, fees, and tips, this includes other forms of compensation such as fringe benefits and stock options.

How do you fill out a cash flow worksheet?

- Review the cash flows options for the engagement.

- Define the closing cash and cash equivalents.

- Determine the number of analysis items.

- Complete the analysis items.

- Balance the Cash Flow Worksheet.

To have a healthy free cash flow, you want to have enough free cash on hand to be able to pay all of your company's bills and costs for a month, and the more you surpass that number, the better. Some investors and analysts believe that a good free cash flow for a SaaS company is anywhere from about 20% to 25%.

ChartExpo is an add-in you can easily install in your Excel without needing tutorials. With many ready-to-go charts, graphs, and maps, the ChartExpo turns your complex, raw data into easy-to-interpret and visually appealing Cash Flow Diagrams using Sankey Chart in Excel that tell data stories in real-time.

Revenue should also be understood as a one-way inflow of money into a company, while cash flow represents inflows and outflows of cash. Therefore, unlike revenue, cash flow has the possibility of being a negative number.

To convert your accrual net profit to cash, you must subtract an increase in accounts receivable. The increase represents income that has been recorded but not yet collected in cash. A decrease in accounts receivable has the opposite effect — the decrease represents cash collected, but not included in income.

References

- https://clickup.com/blog/flowchart-software/

- https://www.learnsignal.com/blog/excel-finance-guide-top-5-functions/

- https://www.gurufocus.com/term/pfcf/MSFT/Price-to-Free-Cash-Flow/MSFT

- https://support.microsoft.com/en-au/office/fvschedule-function-bec29522-bd87-4082-bab9-a241f3fb251d

- https://edrawmax.wondershare.com/flowchart/microsoft-flowchart.html

- https://www.investopedia.com/ask/answers/033015/what-formula-calculating-free-cash-flow.asp

- https://www.investopedia.com/ask/answers/071515/what-formula-calculating-free-cash-flow-excel.asp

- https://www.lucidchart.com/blog/data-flow-diagram-tutorial

- https://www.lucidchart.com/pages/examples/flowchart-maker

- https://agicap.com/en/article/cash-flow-from-operations/

- https://www.investopedia.com/ask/answers/040315/how-do-you-calculate-present-value-excel.asp

- https://www.quora.com/Why-does-Excel-show-the-future-value-as-a-negative-of-the-present-value

- https://aofund.org/resource/how-write-cash-flow-statement/

- https://www.bankofamerica.com/smallbusiness/resources/post/cash-flow-management-basics-for-small-businesses/

- https://www.shopify.com/nz/blog/positive-cash-flow

- https://www.investopedia.com/ask/answers/011315/what-difference-between-cash-flow-and-revenue.asp

- https://online.hbs.edu/blog/post/how-to-prepare-a-cash-flow-statement

- https://support.microsoft.com/en-us/office/video-create-a-chart-4d95c6a5-42d2-4cfc-aede-0ebf01d409a8

- https://www.alphaacademy.org/how-to-plot-graph-in-excel/

- https://openpress.usask.ca/engecon/front-matter/cash-flows-and-cash-flow-diagrams/

- https://www.datarails.com/cash-flow-report/

- https://agicap.com/en/article/cash-flow-table/

- https://quizlet.com/517113139/acct-2301-ch-14-flash-cards/

- https://clickup.com/blog/flowchart-in-excel/

- https://miro.com/flowchart/

- https://unmudl.com/blog/valuable-excel-skills

- https://www.linkedin.com/pulse/ebitda-proxy-cash-flow-eric-mersch-ia37f

- https://www.inc.com/encyclopedia/cash-flow-statement.html

- https://corporatefinanceinstitute.com/resources/excel/fv-function-excel/

- https://www.americanexpress.com/en-gb/business/trends-and-insights/articles/how-to-calculate-cash-flow/

- https://www.indeed.com/career-advice/career-development/calculate-npv

- https://www.ablebits.com/office-addins-blog/excel-pmt-function-formula-examples/

- https://www.nolo.com/legal-encyclopedia/free-books/small-business-book/chapter14-3.html

- https://www.breezetree.com/articles/flowchart-excel-vs-word

- https://www.wolterskluwer.com/en/expert-insights/the-difference-between-cash-flow-and-profit

- https://support.microsoft.com/en-gb/office/create-a-data-visualizer-diagram-17211b46-d144-4ca2-9ea7-b0f48f0ae0a6

- https://www.lendingtree.com/business/cash-flow-analysis/

- https://www.investopedia.com/terms/c/cashflow.asp

- https://gocardless.com/guides/posts/how-to-prepare-cash-flow-statement/

- https://www.edrawmax.com/flowchart/process-map-vs-flowchart.html

- https://www.freshbooks.com/hub/accounting/cash-flow-formula

- https://www.cubesoftware.com/blog/direct-vs-indirect-method

- https://www.investopedia.com/terms/o/ocfratio.asp

- https://ca.indeed.com/career-advice/career-development/how-to-make-flowchart-in-word

- https://www.goldenappleagencyinc.com/blog/cash-flow-statement-vs-profit-loss

- https://zebrabi.com/cash-flow-statement-in-excel/

- https://www.canva.com/learn/flowchart-design-tips/

- https://www.sec.gov/Archives/edgar/data/70033/000119312505163969/dex994.htm

- https://www.pwc.com/gx/en/services/entrepreneurial-private-business/small-business-solutions/blogs/preparing-a-cash-flow-forecast-simple-steps-for-vital-insight.html

- https://corporatefinanceinstitute.com/resources/valuation/net-present-value-npv/

- https://gocardless.com/guides/posts/cash-flow-chart/

- https://fmx.cpa.texas.gov/fmx/training/wbt/cashflow/240.php

- https://www.americanexpress.com/en-us/business/trends-and-insights/articles/cash-flow-management-how-much-cash-should-you-keep-in-your-business/

- https://www.waveapps.com/blog/cash-flow-projection

- https://www.investopedia.com/articles/stocks/07/easycashflow.asp

- https://countingup.com/resources/what-is-a-healthy-cash-flow-ratio/

- https://www.xlteq.com/excel-downloads-cash-flow-template

- https://countingtheapples.com/advantages-and-disadvantages-of-a-cash-flow-forecast/

- https://techcommunity.microsoft.com/t5/excel/i-have-the-discounted-cash-flow-model-formula-but-have-no-clue/td-p/3949892

- https://taulia.com/glossary/what-is-cash-flow-forecasting/

- https://agicap.com/en/article/what-is-the-difference-between-ebitda-and-free-cash-flow/

- https://www.unomaha.edu/nebraska-business-development-center/_files/publications/cash-flow.pdf

- https://www.cfainstitute.org/en/membership/professional-development/refresher-readings/free-cash-flow-valuation

- https://payhawk.com/blog/the-purpose-of-a-cash-flow-statement

- https://global.oup.com/us/companion.websites/9780199339273/student/interactive/ecce/cfd/

- https://www.citizensbank.com/learning/what-is-cash-flow.aspx

- https://www.irs.gov/businesses/small-businesses-self-employed/what-is-taxable-and-nontaxable-income

- https://www.investopedia.com/ask/answers/051315/how-do-you-calculate-payback-period-using-excel.asp

- https://www.mca.gov.in/Ministry/notification/pdf/AS_3.pdf

- https://link.springer.com/chapter/10.1007/978-1-4684-6539-6_36

- https://www.shopify.com/blog/cash-flow-statement

- https://www.linkedin.com/pulse/why-using-spreadsheets-financial-consolidation-reporting

- https://www.bankofamerica.com/smallbusiness/resources/post/free-cash-flow/

- https://www.mosaic.tech/financial-metrics/free-cash-flow

- https://gocardless.com/en-us/guides/posts/cash-flow-vs-profit/

- https://finmark.com/cash-flow-statement-vs-balance-sheet/

- https://www.yellowfinbi.com/blog/how-to-perform-cash-flow-analysis-using-yellowfin-waterfall-charts

- https://www.mindmesh.com/glossary/what-is-positive-cash-flow

- https://www.linkedin.com/pulse/interpreting-cash-flow-statement-accounting-basics-fpa-asif-masani

- https://agicap.com/en/article/cash-flow-positive/

- https://www.lucidchart.com/pages/how-to-make-a-flowchart-in-excel

- https://www.alphaspread.com/security/nasdaq/aapl/financials/cash-flow-statement/free-cash-flow

- https://www.investopedia.com/ask/answers/032715/what-difference-between-balance-sheet-and-cash-flow-statement.asp

- https://ppcexpo.com/blog/cash-flow-chart

- https://support.microsoft.com/en-gb/office/introduction-to-what-if-analysis-22bffa5f-e891-4acc-bf7a-e4645c446fb4

- https://corp.yonyx.com/customer-service/is-excel-or-word-better-for-flowchart-mapping/

- https://www.investopedia.com/investing/what-is-a-cash-flow-statement/

- https://www.wallstreetmojo.com/direct-vs-indirect-cash-flow-methods/

- https://www.macrotrends.net/stocks/charts/NVDA/nvidia/free-cash-flow

- https://www.shopify.com/ph/blog/cash-flow-statement

- https://www.investopedia.com/ask/answers/012615/how-do-you-calculate-operating-cash-flow-excel.asp

- https://support.microsoft.com/en-us/office/go-with-the-cash-flow-calculate-npv-and-irr-in-excel-9e3d78bb-f1de-4f8e-a20e-b8955851690c

- https://www.waveapps.com/blog/cash-flow-formula

- https://support.microsoft.com/en-us/office/importing-data-into-visio-an-overview-8e142a9b-3d73-429a-809f-4832258801d2

- https://info.aiim.org/aiim-blog/flowcharting-in-business-process-management

- https://www.amazon.com/Cash-Flow-Dummies-John-Tracy/dp/1118018508

- https://tipalti.com/accounting-hub/cash-flow-analysis/

- https://support.microsoft.com/en-au/office/video-create-a-flowchart-8ff7ba4d-cbfd-4977-95ab-51d9017071b9

- https://www.investopedia.com/ask/answers/111314/whats-difference-between-free-cash-flow-and-operating-cash-flow.asp

- https://wealthfactory.com/articles/tips-for-boosting-cash-flow-in-a-struggling-business/

- https://chartexpo.com/blog/cash-flow-diagram-in-excel

- https://www.fess.ie/images/stories/ResourcesForTutors/Resource_Lists_Level_5/InvestigateCommonUsesForSpreadsheets.pdf

- https://gocardless.com/en-us/guides/posts/how-to-calculate-net-present-value/

- https://www.oreilly.com/library/view/project-management-accounting/9781118078228/c07anchor-6.html

- https://online.hbs.edu/blog/post/cash-flow-vs-profit

- https://edrawmax.wondershare.com/flowchart/how-to-create-cash-flow-diagram-in-excel.html

- https://lausconsult.com/the-4-sectors-of-the-cash-flow-statement-you-need-to-know-to-survive/

- https://support.caseware.com.au/portal/en/kb/articles/how-do-i-use-the-cash-flow-worksheet

- https://babington.co.uk/insights/help-guidance/the-benefits-of-using-spreadsheets-in-accounting/

- https://quickbooks.intuit.com/r/bookkeeping/excel-accounting-bookkeeping/

- https://support.microsoft.com/en-au/office/create-a-basic-flowchart-in-visio-e207d975-4a51-4bfa-a356-eeec314bd276

- https://learn.microsoft.com/en-us/power-platform/admin/power-automate-licensing/faqs

- https://www.simplilearn.com/tutorials/excel-tutorial/excel-what-if-analysis

- https://chartexpo.com/blog/analyzing-cash-flow

- https://www.ablebits.com/office-addins-blog/calculate-npv-excel-net-present-value-formula/

- https://northstaranalytics.co.uk/cash-flow-management-budgeting-with-excel-google-sheets/

- https://www.wallstreetprep.com/knowledge/fv-function/

- https://beprofit.co/a/community/profit-calculation/what-is-the-formula-for-calculating-fcf-in-excel

- https://tipalti.com/accounting-hub/discounted-cash-flow/

- https://www.ascensionaccountants.com/blog/key-cash-flow-kpis-you-should-keep-an-eye-on/

- https://www.makeuseof.com/make-cash-flow-statement-microsoft-excel/